All Categories

Featured

Table of Contents

Term life insurance coverage is a type of policy that lasts a details length of time, called the term. You choose the length of the policy term when you initially take out your life insurance coverage.

Choose your term and your quantity of cover. You may need to respond to some inquiries concerning your case history. Select the plan that's right for you. Now, all you need to do is pay your costs. As it's level term, you know your premiums will certainly remain the exact same throughout the term of the policy.

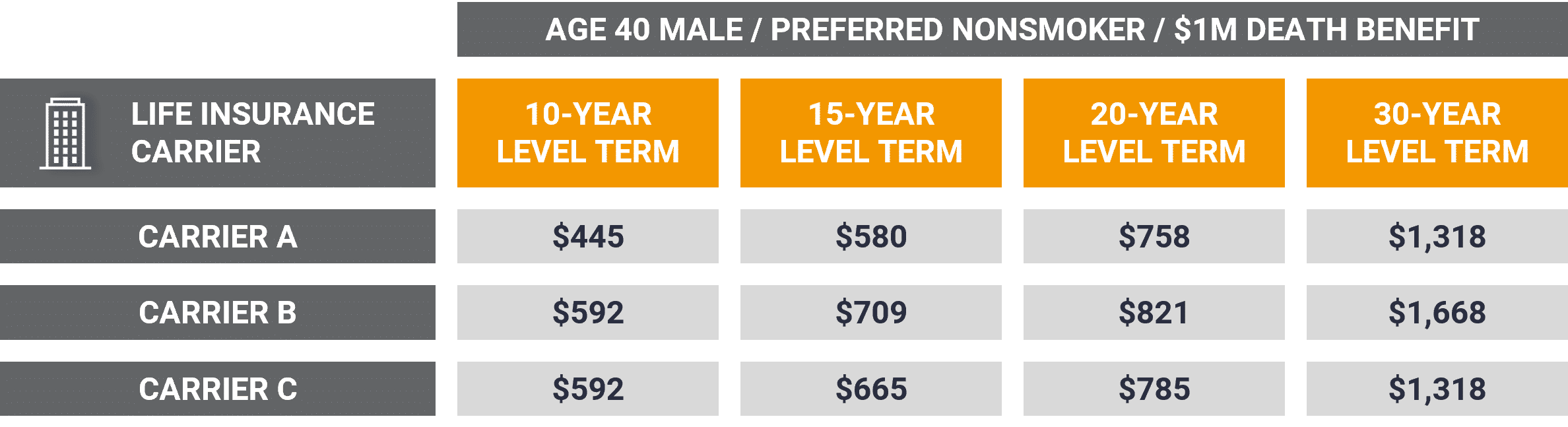

Level Term Life Insurance Rates

Life insurance covers most situations of fatality, but there will certainly be some exemptions in the terms of the policy - Guaranteed level term life insurance.

Hereafter, the plan finishes and the enduring companion is no more covered. Individuals often secure joint policies if they have exceptional monetary dedications like a home loan, or if they have children. Joint policies are generally much more affordable than single life insurance policy policies. Other sorts of term life insurance plan are:Reducing term life insurance coverage - The amount of cover lowers over the size of the plan.

This safeguards the buying power of your cover quantity against inflationLife cover is a great point to have due to the fact that it supplies economic defense for your dependents if the most awful occurs and you pass away. Your loved ones can also utilize your life insurance policy payout to spend for your funeral. Whatever they select to do, it's great tranquility of mind for you.

However, degree term cover is wonderful for fulfilling daily living expenditures such as house expenses. You can likewise use your life insurance policy advantage to cover your interest-only home mortgage, settlement mortgage, school fees or any kind of various other financial obligations or continuous settlements. On the various other hand, there are some disadvantages to level cover, compared to various other sorts of life policy.

Level Term Life Insurance For Seniors

Words "degree" in the expression "level term insurance" suggests that this kind of insurance policy has a set premium and face amount (death benefit) throughout the life of the plan. Basically, when people speak about term life insurance policy, they normally refer to degree term life insurance policy. For most of individuals, it is the most basic and most inexpensive option of all life insurance policy types.

Words "term" below describes a provided number of years throughout which the degree term life insurance stays active. Degree term life insurance policy is among one of the most preferred life insurance policy policies that life insurance policy carriers offer to their clients as a result of its simplicity and affordability. It is likewise very easy to contrast level term life insurance policy quotes and get the very best premiums.

The system is as adheres to: To start with, select a policy, fatality advantage amount and plan duration (or term size). Secondly, choose to pay on either a regular monthly or yearly basis. If your early death occurs within the life of the policy, your life insurance company will pay a round figure of death advantage to your established recipients.

Who are the cheapest Affordable Level Term Life Insurance providers?

Your degree term life insurance plan runs out when you come to the end of your plan's term. Option B: Get a new degree term life insurance coverage policy.

Your present web browser might restrict that experience. You might be using an old web browser that's unsupported, or settings within your browser that are not suitable with our site.

Who provides the best Level Term Life Insurance Protection?

Currently making use of an updated web browser and still having trouble? Please provide us a telephone call at for additional support. Your present browser: Spotting ...

If the policy ends before your death or you live past the policy term, there is no payment. You might have the ability to renew a term plan at expiry, however the premiums will be recalculated based on your age at the time of renewal. Term life is typically the the very least costly life insurance readily available since it supplies a survivor benefit for a limited time and doesn't have a money value component like permanent insurance coverage has.

Whole Life Insurance Coverage Fees 30 $282 $247 40 $382 $352 50 $571 $498 60 $887 $782 Source: Quotacy. Quotes are for a $500,000 irreversible life insurance policy, for guys and ladies in excellent health.

How do I choose the right Level Death Benefit Term Life Insurance?

That reduces the total threat to the insurance firm compared to an irreversible life plan. The reduced risk is one aspect that allows insurance providers to charge reduced premiums. Rate of interest, the financials of the insurer, and state policies can also influence costs. In general, companies usually provide much better rates at the "breakpoint" protection degrees of $100,000, $250,000, $500,000, and $1,000,000.

Check our referrals for the best term life insurance policy policies when you are prepared to acquire. Thirty-year-old George desires to shield his household in the unlikely occasion of his sudden death. He gets a 10-year, $500,000 term life insurance policy plan with a costs of $50 each month. If George dies within the 10-year term, the policy will certainly pay George's beneficiary $500,000.

If he lives and restores the policy after 10 years, the costs will be greater than his initial policy due to the fact that they will be based on his existing age of 40 rather than 30. Level term life insurance companies. If George is detected with a terminal disease throughout the initial plan term, he possibly will not be qualified to restore the policy when it expires

There are a number of types of term life insurance. The ideal alternative will certainly depend on your individual scenarios. The majority of term life insurance policy has a level premium, and it's the type we've been referring to in most of this write-up.

How do I cancel Term Life Insurance With Fixed Premiums?

They might be an excellent choice for somebody that requires temporary insurance coverage. The policyholder pays a repaired, degree costs for the period of the policy.

Latest Posts

What is 30-year Level Term Life Insurance? A Simple Breakdown

How do I choose the right Senior Protection?

How Does Level Term Life Insurance Protect Your Loved Ones?