All Categories

Featured

Table of Contents

- – What is included in What Is Level Term Life In...

- – What does a basic What Is Level Term Life Insu...

- – Who offers Level Term Life Insurance For Fami...

- – Who provides the best Level Term Life Insuran...

- – How do I cancel Tax Benefits Of Level Term L...

- – What is included in What Is Level Term Life ...

Premiums are normally reduced than entire life policies. With a degree term plan, you can select your coverage amount and the policy size. You're not locked into an agreement for the remainder of your life. Throughout your policy, you never ever need to bother with the premium or survivor benefit quantities changing.

And you can't squander your policy during its term, so you will not obtain any type of financial gain from your previous protection. Just like various other kinds of life insurance policy, the price of a level term policy relies on your age, coverage needs, work, lifestyle and wellness. Typically, you'll discover a lot more economical insurance coverage if you're younger, healthier and less high-risk to guarantee.

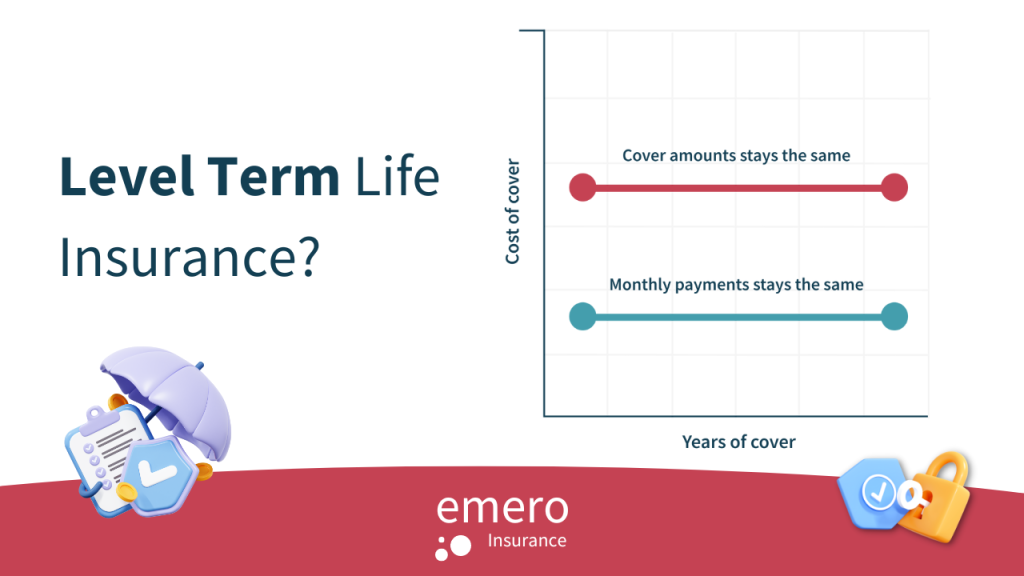

Considering that level term premiums stay the very same for the period of insurance coverage, you'll know exactly how much you'll pay each time. Level term insurance coverage likewise has some flexibility, enabling you to customize your policy with added functions.

You may have to meet specific problems and qualifications for your insurer to enact this cyclist. Additionally, there might be a waiting period of approximately 6 months prior to working. There also can be an age or time frame on the coverage. You can include a youngster motorcyclist to your life insurance policy policy so it also covers your youngsters.

What is included in What Is Level Term Life Insurance? coverage?

The death benefit is normally smaller, and coverage generally lasts till your youngster turns 18 or 25. This biker may be an extra economical way to help guarantee your youngsters are covered as motorcyclists can typically cover numerous dependents simultaneously. Once your child ages out of this insurance coverage, it might be possible to convert the rider into a new policy.

The most common kind of long-term life insurance is whole life insurance, however it has some vital distinctions compared to degree term protection. Below's a standard review of what to consider when contrasting term vs.

Whole life entire lasts insurance coverage life, while term coverage lasts protection a specific periodParticular The costs for term life insurance coverage are generally lower than entire life insurance coverage.

What does a basic What Is Level Term Life Insurance? plan include?

One of the highlights of degree term coverage is that your premiums and your death benefit don't transform. With decreasing term life insurance, your costs remain the same; nonetheless, the fatality advantage quantity gets smaller sized gradually. You may have protection that starts with a death advantage of $10,000, which can cover a home mortgage, and after that each year, the fatality benefit will lower by a set quantity or percentage.

Due to this, it's typically a much more affordable type of degree term protection., yet it may not be sufficient life insurance policy for your demands.

After making a decision on a policy, finish the application. If you're authorized, authorize the paperwork and pay your very first costs.

Finally, take into consideration organizing time annually to assess your policy. You might wish to upgrade your beneficiary details if you have actually had any kind of significant life modifications, such as a marital relationship, birth or divorce. Life insurance policy can in some cases feel challenging. You don't have to go it alone. As you explore your options, take into consideration discussing your requirements, desires and worries about an economic professional.

Who offers Level Term Life Insurance For Families?

No, degree term life insurance does not have money worth. Some life insurance plans have a financial investment attribute that permits you to build cash value with time. Level term life insurance companies. A portion of your costs repayments is alloted and can gain rate of interest with time, which expands tax-deferred during the life of your insurance coverage

These plans are often substantially much more pricey than term protection. If you get to the end of your plan and are still active, the insurance coverage ends. You have some alternatives if you still want some life insurance policy coverage. You can: If you're 65 and your protection has actually gone out, as an example, you might intend to purchase a new 10-year level term life insurance policy policy.

Who provides the best Level Term Life Insurance Quotes?

You may have the ability to convert your term coverage right into a whole life plan that will last for the rest of your life. Many kinds of degree term plans are exchangeable. That suggests, at the end of your protection, you can transform some or every one of your policy to entire life insurance coverage.

Degree term life insurance policy is a plan that lasts a set term typically in between 10 and 30 years and features a level survivor benefit and level premiums that stay the same for the entire time the plan holds. This implies you'll recognize precisely just how much your payments are and when you'll need to make them, permitting you to spending plan accordingly.

Degree term can be a wonderful choice if you're wanting to buy life insurance coverage for the initial time. According to LIMRA's 2023 Insurance coverage Measure Research, 30% of all adults in the united state requirement life insurance policy and do not have any kind of plan yet. Level term life is predictable and budget-friendly, that makes it among one of the most preferred kinds of life insurance coverage

A 30-year-old male with a comparable profile can expect to pay $29 per month for the exact same insurance coverage. AgeGender$250,000 coverage quantity$500,000 coverage quantity$1 million protection amount20Female$15$23$34Male$19$29$4830Female$15$23$37Male$18$29$4940Female$22$35$61Male$25$43$7550Female$44$78$139Male$57$102$18860Female$108$194$355Male$149$268$500 Collapse table Methodology: Ordinary month-to-month rates are calculated for male and women non-smokers in a Preferred wellness classification obtaining a 20-year $250,000, $500,000, or $1,000,000 term life insurance policy plan.

How do I cancel Tax Benefits Of Level Term Life Insurance?

Prices may vary by insurance firm, term, insurance coverage quantity, wellness course, and state. Not all policies are offered in all states. Rate image valid as of 09/01/2024. It's the most inexpensive form of life insurance policy for the majority of people. Degree term life is a lot more budget-friendly than a comparable whole life insurance policy plan. It's very easy to manage.

It permits you to budget plan and prepare for the future. You can quickly factor your life insurance policy right into your budget plan since the costs never alter. You can plan for the future equally as easily since you understand precisely just how much cash your liked ones will obtain in the event of your lack.

What is included in What Is Level Term Life Insurance? coverage?

This holds true for people that gave up cigarette smoking or that have a wellness problem that deals with. In these situations, you'll normally have to go through a new application procedure to obtain a better price. If you still require coverage by the time your level term life plan nears the expiration date, you have a few options.

Table of Contents

- – What is included in What Is Level Term Life In...

- – What does a basic What Is Level Term Life Insu...

- – Who offers Level Term Life Insurance For Fami...

- – Who provides the best Level Term Life Insuran...

- – How do I cancel Tax Benefits Of Level Term L...

- – What is included in What Is Level Term Life ...

Latest Posts

Instant Term Life Insurance Coverage

Average Cost Of Final Expense Insurance

Cremation Insurance

More

Latest Posts

Instant Term Life Insurance Coverage

Average Cost Of Final Expense Insurance

Cremation Insurance