All Categories

Featured

Table of Contents

- – How do I get 20-year Level Term Life Insurance?

- – Is there a budget-friendly Tax Benefits Of Lev...

- – Who provides the best Compare Level Term Life...

- – How do I compare 30-year Level Term Life Insu...

- – Who provides the best 20-year Level Term Lif...

- – What should I look for in a Level Term Life ...

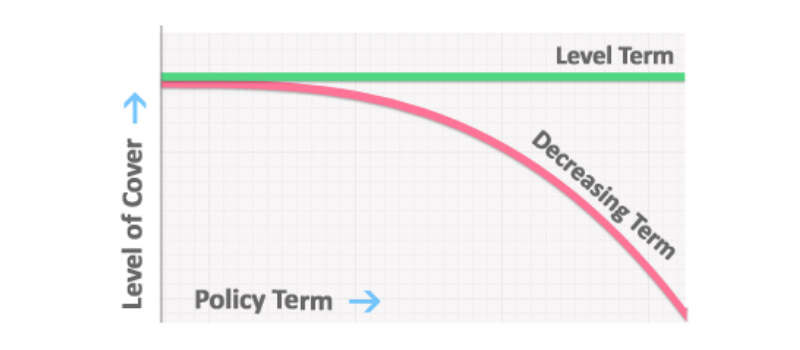

Term life insurance policy is a sort of policy that lasts a certain size of time, called the term. You pick the size of the policy term when you initially get your life insurance policy. Maybe 5 years, twenty years and even extra. If you pass away throughout the pre-selected term (and you have actually stayed on top of your premiums), your insurer will certainly pay out a round figure to your chosen recipients.

Select your term and your quantity of cover. Select the plan that's right for you., you understand your premiums will certainly stay the very same throughout the term of the plan.

How do I get 20-year Level Term Life Insurance?

Life insurance policy covers most scenarios of fatality, however there will certainly be some exclusions in the terms of the plan - Level term life insurance quotes.

After this, the plan ends and the enduring companion is no longer covered. Joint policies are normally more cost effective than solitary life insurance coverage policies.

This safeguards the buying power of your cover quantity versus inflationLife cover is a terrific point to have because it supplies monetary defense for your dependents if the worst takes place and you pass away. Your loved ones can likewise use your life insurance policy payment to spend for your funeral. Whatever they choose to do, it's fantastic peace of mind for you.

Nonetheless, degree term cover is terrific for fulfilling everyday living expenses such as home bills. You can likewise use your life insurance policy advantage to cover your interest-only home mortgage, payment mortgage, institution costs or any kind of various other financial debts or continuous payments. On the various other hand, there are some drawbacks to degree cover, compared to other kinds of life policy.

Is there a budget-friendly Tax Benefits Of Level Term Life Insurance option?

Words "degree" in the phrase "degree term insurance" indicates that this sort of insurance has a fixed costs and face quantity (survivor benefit) throughout the life of the plan. Put simply, when individuals talk concerning term life insurance coverage, they normally describe degree term life insurance policy. For most of individuals, it is the most basic and most economical selection of all life insurance policy types.

The word "term" below describes a provided variety of years throughout which the degree term life insurance policy remains energetic. Level term life insurance policy is one of the most prominent life insurance policy policies that life insurance companies offer to their clients because of its simplicity and cost. It is likewise very easy to contrast degree term life insurance policy quotes and obtain the most effective costs.

The device is as follows: Firstly, select a policy, death benefit quantity and policy period (or term length). Secondly, select to pay on either a monthly or yearly basis. If your early death happens within the life of the policy, your life insurer will certainly pay a lump sum of survivor benefit to your fixed beneficiaries.

Who provides the best Compare Level Term Life Insurance?

Your degree term life insurance policy plan runs out when you come to the end of your policy's term. Now, you have the following options: Alternative A: Keep without insurance. This option matches you when you can guarantee by yourself and when you have no debts or dependents. Alternative B: Acquire a new level term life insurance plan.

Your existing web browser might limit that experience. You might be using an old web browser that's unsupported, or settings within your web browser that are not compatible with our site.

How do I compare 30-year Level Term Life Insurance plans?

Currently using an updated internet browser and still having difficulty? Your existing internet browser: Detecting ...

If the policy expires plan your death or fatality live beyond the past term, there is no payout. You may be able to renew a term policy at expiration, but the costs will certainly be recalculated based on your age at the time of renewal.

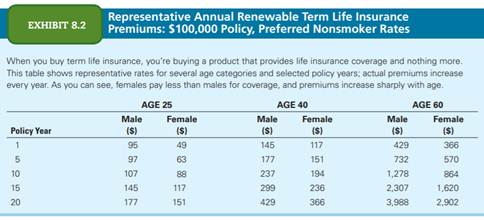

Whole Life Insurance Rates 30 $282 $247 40 $382 $352 50 $571 $498 60 $887 $782 Source: Quotacy. Quotes are for a $500,000 long-term life insurance plan, for guys and women in superb health.

Who provides the best 20-year Level Term Life Insurance?

That decreases the overall danger to the insurance company contrasted to a permanent life plan. Interest rates, the financials of the insurance policy company, and state laws can also affect costs.

He gets a 10-year, $500,000 term life insurance plan with a costs of $50 per month. If George dies within the 10-year term, the policy will certainly pay George's beneficiary $500,000.

If he stays active and renews the policy after ten years, the premiums will certainly be higher than his first policy due to the fact that they will certainly be based upon his existing age of 40 rather than 30. Level term life insurance for seniors. If George is detected with a terminal disease throughout the initial plan term, he possibly will not be eligible to restore the plan when it ends

There are several sorts of term life insurance policy. The finest choice will certainly depend on your individual situations. Usually, most companies offer terms ranging from 10 to three decades, although a few deal 35- and 40-year terms. Level-premium insurance policy has a set month-to-month payment for the life of the policy. Most term life insurance policy has a degree premium, and it's the type we have actually been describing in many of this article.

What should I look for in a Level Term Life Insurance Calculator plan?

They might be a great alternative for someone who needs temporary insurance. The insurance holder pays a dealt with, level premium for the period of the policy.

Table of Contents

- – How do I get 20-year Level Term Life Insurance?

- – Is there a budget-friendly Tax Benefits Of Lev...

- – Who provides the best Compare Level Term Life...

- – How do I compare 30-year Level Term Life Insu...

- – Who provides the best 20-year Level Term Lif...

- – What should I look for in a Level Term Life ...

Latest Posts

What is 30-year Level Term Life Insurance? A Simple Breakdown

How do I choose the right Senior Protection?

How Does Level Term Life Insurance Protect Your Loved Ones?

More

Latest Posts

What is 30-year Level Term Life Insurance? A Simple Breakdown

How do I choose the right Senior Protection?

How Does Level Term Life Insurance Protect Your Loved Ones?